how to calculate pre tax benefits

Benefits of Pre-tax Deductions. You can use the cents-per-mile rule if either of the following requirements is met.

After Tax 401 K Contributions Retirement Benefits Fidelity

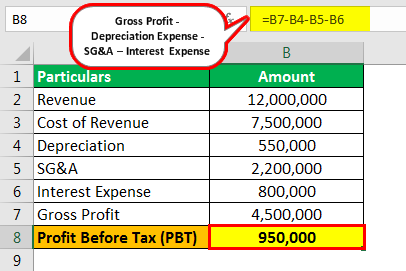

1000 50 950.

. How much can pre-tax contributions reduce your taxes. Additionally since they are not mandatory the decrease of taxable income comes along with the benefits of your choice. This permalink creates a unique url for this online calculator with your saved information.

The employees taxable income is 950 for the pay period. Post-tax contributions for benefits do not reduce overall tax. Pre-tax deductions reduce the employees taxable income which can save them money when filing their federal income tax.

Personal use is any use of the vehicle other than use in your trade or business. Taxes affect the overall earnings of a company. First subtract the 50 pre-tax withholding from the employees gross pay 1000.

Since your insurance plan isnt taxable your employer does not include your premiums on your W-2. For instance on a Pre-EMI of Rs5 lakhs Rs 1 lakh will be depicted as tax deduction for the next 5 years. This amount must be included in the employees wages or reimbursed by the employee.

23000 is 6200 more than 16800. By offering employees a pre-tax commuter benefit program the cost of commuting deducted for employees reduces the amount of payroll being taxed. A pre-tax benefit plan is an account which you sign up for through your employer and fund through payroll deductions.

There are two types of benefits deductions. To determine your total gross wages earned for the year factor in. As well as non- cash expenses like depreciation and other charges from the total income generated but before.

Say you have an employee with a pre-tax deduction. You could just take 100 from your net pay and set it aside in an investment but heres a better idea. For example if you make 12 payments of 1400 over the course of the year that adds up to a debt service of 16800.

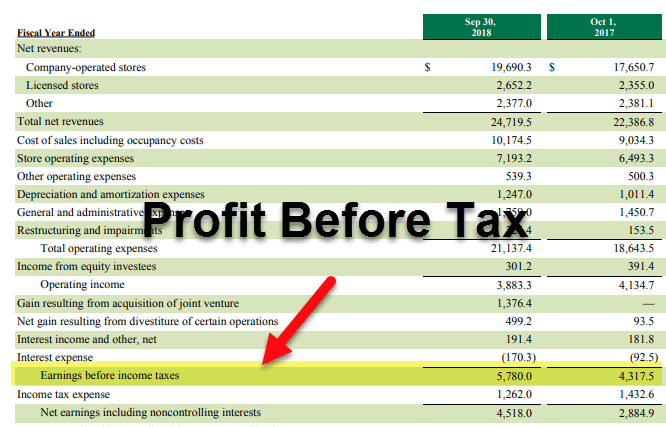

The money is pulled from your paycheck before taxes. Profit before taxes and earnings before interest and tax EBIT EBIT Guide EBIT stands for Earnings Before Interest and Taxes and is one of the last subtotals in the income statement before net income. Note that the tax calculations are based on your overall tax rate.

StateLocal Tax Rate Percentage to estimate your combined state and local income tax rate. Lets start by defining a pre-tax benefit plan. Your annual W-2 includes your taxable wages for the year.

If you contribute a portion of your salary on a dollar. For example you earn 1200 biweekly. Pretax income is the net earnings of the business calculated after deducting all the expenses including cash expenses like salary expense interest expense etc.

Pre-EMI is only the interest paid during the period. Pre-Tax financial income is just like it sounds - its the earnings a company generates before deducting the taxes it needs to pay. Profit Before Tax Revenue Expenses Exclusive of the Tax Expense Profit Before Tax 2000000 1750000 250000.

Pretax earnings hence provide an insight into the companys financial performance and standing before its tax expense affects the net earnings and brings about any fluctuations. If you do not have a cafeteria plan the entire 1200 is subject to Social Security tax. Pretax Income Earnings Before Taxes Article by Madhuri Thakur.

Pretax insurance benefits offered under a Section 125 cafeteria plan arent taxable so theyre taken out of your gross wages before taxes are deducted. Significance of Pretax Income. If you contribute that 100.

Subtract the value of your debt service from your NOI. Please note that any principal amount is not eligible for tax deduction. If pretax deductions are counted as taxable wages subtract the benefit.

For 2022 the standard mileage rate is 585 cents per mile. The allure of a particular job is linked to the type and number of benefits your potential employer offers. Pre-tax deductions and post-tax deductions.

If pretax deductions are not included in taxable wages subtract the benefit from gross wages before calculating state or local income tax according to the agencys criteria. Federal Income Tax Rate Choose from the dropdown list. 1 Types of plans.

Visual of a Pre-tax health benefit account reflecting the 3000 of qualified pre-tax expenses and a corresponding 300 to 1000 in tax savings. On completion of the construction the total pre-EMI interest paid in the subsequent years is deductible in 5 equal instalments. Health transportation and retirement.

This means a savings of up to 765 on average on payroll taxes. Pre-tax contributions reduce overall taxable income and provide an immediate tax-break for employees. Therefore you pay 5040 biweekly in Social Security tax.

This entry is optional. What Tax-Deferred Savings Mean for You. Lets say that 25 of your wages are withheld for federal and state income taxes and that you determine you can spare 100 from your net paycheck to save for the future.

Depending on your tax rate and other factors Lets take a look at three common categories of pre-tax benefits that employers offer. However with pre-tax contributions taxes could be owed down the road when the benefits are used. Reviewed by Dheeraj Vaidya CFA FRM.

Provides insight into a companys financial standing. Its advantageous to pre-tax benefits when savings on current taxes is needed. Click to follow the link and save it to your Favorites so you can use it again in the future without having to input your information again.

First and of utmost importance is that before-tax deductions in fact reduce taxes. Pre-Tax Financial Income. Pre-tax deductions are payments toward benefits that are paid directly from an employees paycheck before withholding money for taxes.

Contribution Rate Percentage of your salary youre currently contributing to your plan account. The deduction is 50 per payroll and you pay the employee a gross pay of 1000 per biweekly pay period.

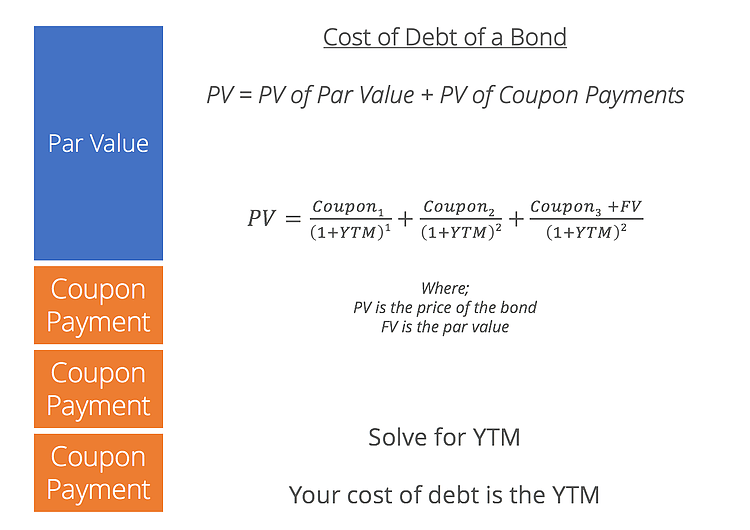

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

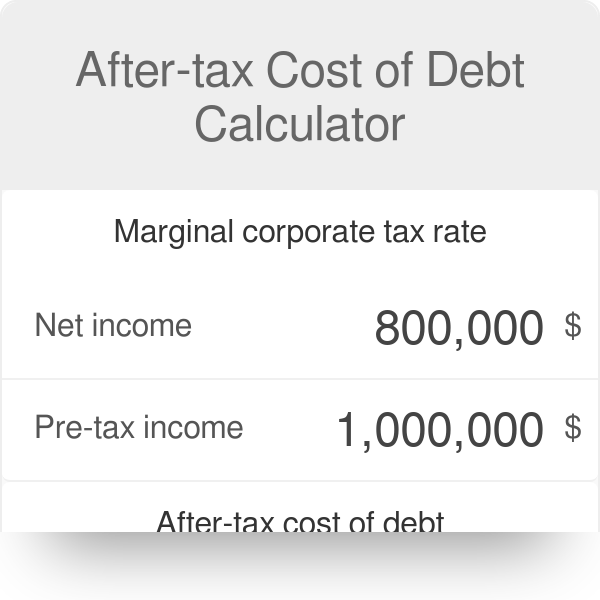

After Tax Cost Of Debt Calculator Required Return Of Debt

What Are Payroll Deductions Article

Cost Of Debt How To Calculate The Cost Of Debt For A Company

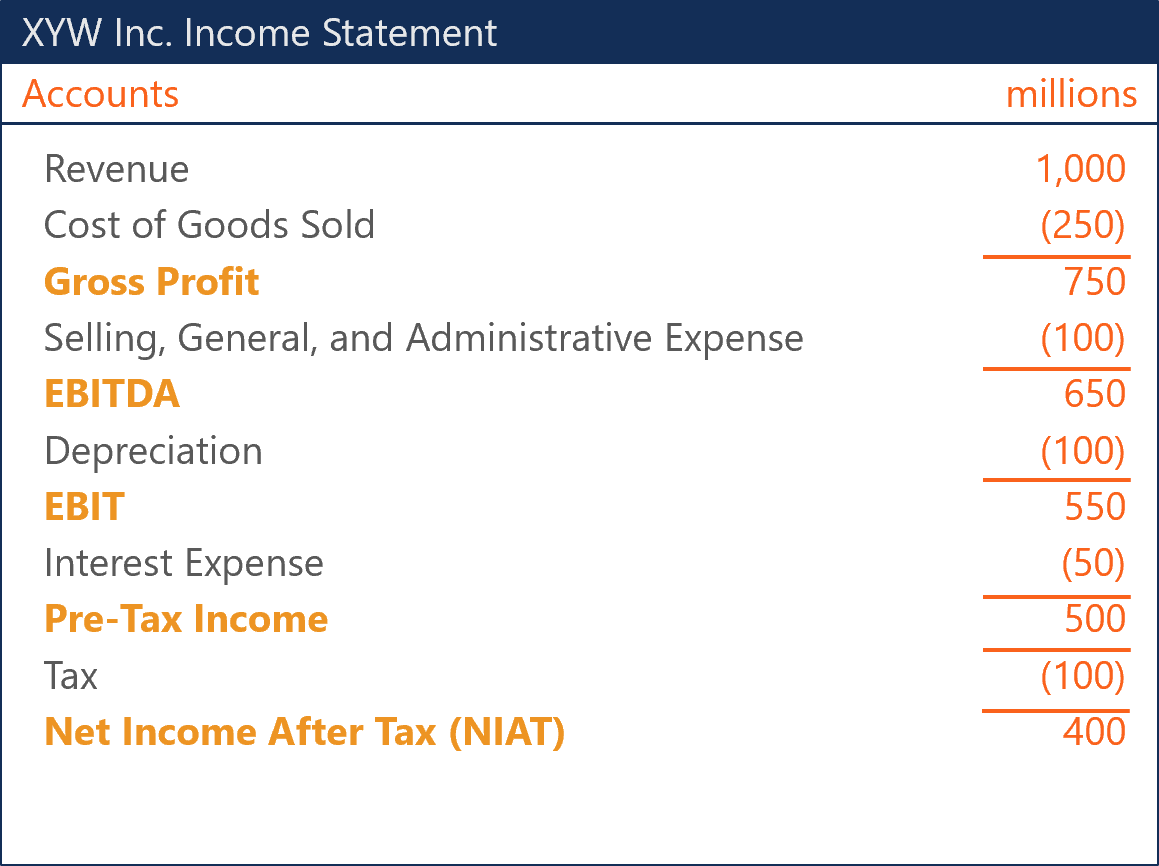

Net Income After Tax Niat Overview How To Calculate Analysis

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

Pretax Income Definition Formula And Example Significance

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Earnings Before Tax Ebt What This Accounting Figure Really Means

Are Payroll Deductions For Health Insurance Pre Tax Details More

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Profit Before Tax Formula Examples How To Calculate Pbt

Pre Tax Vs After Tax Medical Premiums

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

Profit Before Tax Formula Examples How To Calculate Pbt

Profit Before Tax Formula Examples How To Calculate Pbt

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software